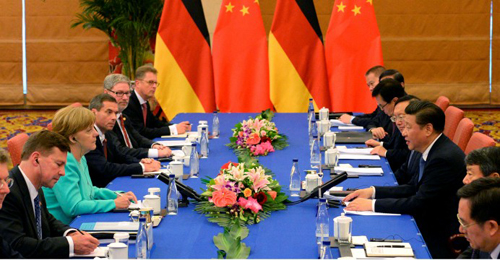

The deal was signed during a visit by German Chancellor Angela Merkel

(third from left) to China, where she met with Chinese President

Xi Jinping (third from right) at Beijing Hotel in Beijing on Monday.

China Three Gorges, which operates the world’s largest hydropower plant on China’s Yangtze river, will buy German offshore wind park Meerwind from US buyout firm Blackstone, the companies said.

The terms of the sale were not disclosed but people familiar with the process have told that they expected it to be valued at around 1.6 billion euros (US$1.8 billion).

The deal, signed during a visit by German Chancellor Angela Merkel to China, has German government approval despite growing controversy over Chinese takeovers of German businesses.

China Three Gorges, which seeks to expand beyond hydropower as it faces a saturated domestic hydro market, will buy Blackstone’s majority interest in WindMW GmbH, an offshore wind power joint venture.

WindMW owns Meerwind, a 288-megawatt project in the North Sea and one of Germany’s largest offshore windfarms.

Media reported on Friday that China Three Gorges was closing in on a deal.

The agreement was signed on Monday in the presence of Merkel and Chinese Premier Li Keqiang, the statement said.

It was one of a number of deals expected to be signed during Merkel’s visit.

Airbus agreed to sell 100 helicopters to a Chinese consortium on Monday, while Daimler AG and its Chinese partner, BAIC Motor, pledged to jointly invest 4 billion yuan (US$607.53 million) to expand engine production.

The German government has expressed concerns over foreign takeovers of strategic assets deemed key to the German economy.

Germany has been trying to coordinate a counter-offer for Chinese home appliance maker Midea’s (000333.CN) controversial 4.5 billion euro buyout offer for robotics group Kuka.

Bremerhaven-based WindMW is 80 percent owned by Blackstone and 20 percent by Windland Energieerzeugungs GmbH, and provides electricity for up to 360,000 households.

The present management team will continue to operate the business.

Jefferies, PJT Partners and Bank of America Merrill Lynch acted as financial advisors to Blackstone.

Reuters

Please

contact us in case of Copyright Infringement of the photo sourced from the internet, we will remove it within 24 hours.