The UK offers a range of investment opportunities that correspond to China’s strategic priorities; favourable conditions and a weak pound have seen Chinese investment in London swell in recent months. Chinese companies, however, are faced with an intricate tax regime and stringent rules around employment and data protection to invest in the country – something which UK management consultancies hope to advise on.

Booming personal wealth in China has led to a surge in foreign investment across the world, with Chinese nationals keen to put their money to work wherever opportunity presents itself. While for a long time the developing world has been a key destination for this, Chinese investment has also been flowing into developed countries, including the UK. The falling value of the pound amid Brexit uncertainty has made the UK another hotspot for Chinese investment. In the first half of 2017 alone, this saw £5 billion in Chinese capital sunk into the London real estate scene.

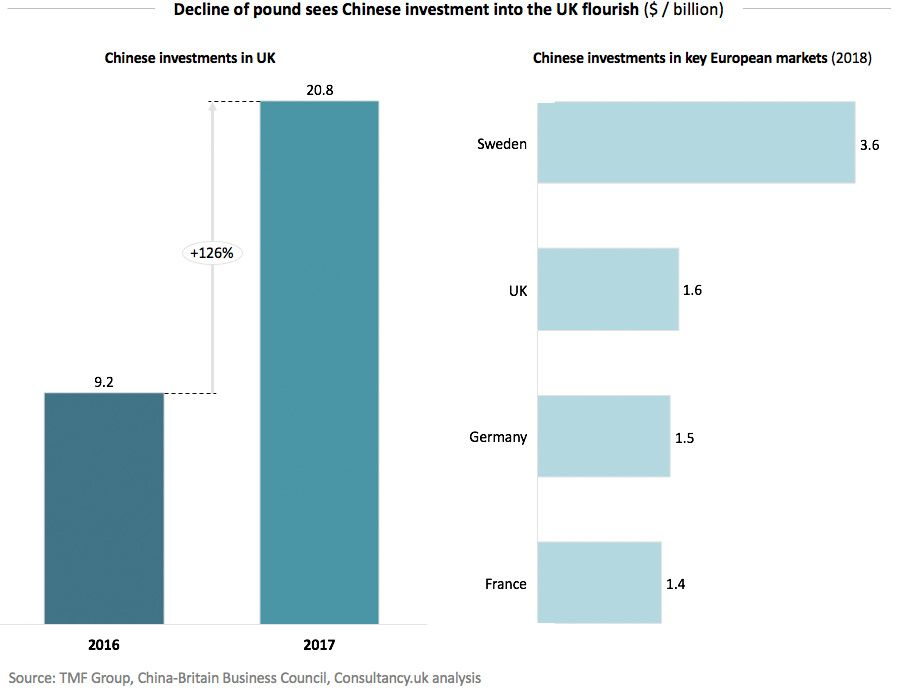

More generally, investment in the UK from China doubled in 2017, totalling $20.8 billion in a year when overall Chinese outbound investment declined for the first time since records began in 2003. According to a new report from consultancy TMF Group and the China-Britain Business Council (CBBC), this trend is set to continue despite some short-term challenges posed by the UK’s exit from the European Union and a rethink by Beijing of its outbound investment priorities.

According to the study, as a mature, services-oriented economy, the UK offers a diverse range of opportunities that have so far yielded robust returns for Chinese investors; however, this is by no means a one-way street. The 30 fastest-growing Chinese companies with investments in the UK enjoy a combined turnover of more than £11 billion, but they also employ more than 5,000 across the country. In this regard it is important to note that while London remains a focal point, Chinese investment in the UK is also growing more diverse in terms of geography.

Residential property inquiries for Manchester, Liverpool, Birmingham and Edinburgh in particular are reported to have experienced three-digit increases in August 2018 over August 2017 by Chinese buyers. Further illustrating this, meanwhile, English football clubs like Reading, Birmingham City, Aston Villa, Southampton, Wolverhampton Wanderers, West Bromwich Albion now all have Chinese owners or Executives at the helm.

At the same time, deal-making activity by Chinese investors is expected to continue on an upward trajectory across Europe, where regulatory obstacles are lower than in the US. In the first half of the year, the UK attracted $1.6 billion in investment from China, outpacing France and Germany, and making it the most attractive European destination after Sweden. However, the researchers were also keen to explain that there is no guarantee that the UK will continue to benefit from this, with certain key uncertainties still hanging over the economy.

Felix Ndeloa, Director of Consultancy Solutions at TMF UK said, “Despite the broadly positive picture there are several forces that could impact future investment trends negatively. Chinese companies may overlook the regulatory and compliance complications of investing in the country. These include an intricate tax regime and stringent rules around employment and data protection. These issues argue for Chinese firms seeking the support of a knowledgeable local partner who can help ensure their operations are compliant and continuously up to date across taxation, accounting, employment and data policy – especially as factors like Brexit seem likely to rapidly shift the picture in some areas. Securing such a partnership will free investors to concentrate on the more strategically important tasks of cultivating their UK presence and building relationships with local enterprises and the community.”

Furthering that point, Weifeng Ma, Director, Financial & Professional Services and China Outbound at CBBC added, “Uncertainties surrounding Brexit could temporarily impact investment activity, but in the long run CBBC is confident that the UK’s investment environment will prove attractive to Chinese investors. As the UK creates new trade and investment relationships after leaving the European Union, China will become an even more important partner.”

Please

contact us in case of Copyright Infringement of the photo sourced from the internet, we will remove it within 24 hours.