A young Chinese-US company backed by internet group Tencent and two mainland media firms is to buy control of IM Global, a Hollywood film and TV studio.

Tang Media Partners, created by Donald Tang, a businessman, has joined CMC and Huayi Brothers to buy the studio from the Reliance group of Anil Ambani, the Indian billionaire.

Mr Tang, a former head of Bear Stearns in Asia, is also partnering with IM Global and Tencent to form a TV joint venture that will include Reliance and produce and distribute television content.

The two IM Global transactions, with a combined value of about $200m, come as China’s internet and media companies jockey to acquire Hollywood assets. Both Tencent and its local rival Alibaba are increasingly interested in producing content for its platforms.

This year Dalian Wanda paid $3.5bn for a controlling stake in Legendary Entertainment, the Hollywood maker of the hit films Godzilla and Jurassic World. In 2014 Hony Capital, the Chinese private equity group, and TPG Capital, a US peer, invested in the STX Entertainment Hollywood studio.

Taking advantage of the growing two-way flows between Hollywood and emerging markets, such as the Chinese and Bollywood markets, IM Global operates a Beijing office and has handled the foreign distribution of hits in China such as The Mermaid. Stuart Ford, who founded IM Global in 2007, will stay on as chief executive.

If the partnership is successful, the China unit could be spun off, said people involved in the transaction.

Mr Tang, who lives in Los Angeles but is originally from Shanghai, has a history of working on Chinese deals in the US entertainment sector. In 2012 he advised Apollo, the private equity firm, and AMC, its portfolio company, on Dalian Wanda’s $2.6bn purchase of AMC’s film theatre chain.

“To use the China angle to make an investment in a US company is attractive,” said Neil Shen, managing partner of venture capital firm Sequoia Capital China. “You need credibility and connections, and Donald has both.”

Mr Tang said: “Content will always be king, but international distribution is increasingly important to both Hollywood and China.” Hollywood studios had long relied on international box office receipts, he added.

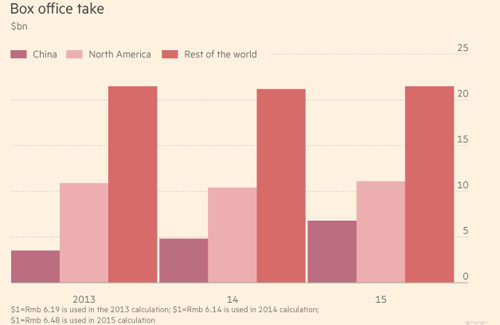

James Fong, chief executive of Oriental DreamWorks, told the Milken Global conference in Los Angeles that box office receipts in China — worth $6.8bn in 2015 — would soon overtake those in the US, which were $11bn in North America over the period.

China’s growing role in Hollywood is likely to result in changes in the way films are marketed, given the expense involved, said Mr Tang.

“China is very cost-conscious and far more digitally oriented than the US. It relies much more on social and digital media to promote films,” he said. “There is much that Hollywood can learn from China.”

China is eager to acquire Hollywood know-how, especially since Beijing regulates the number of foreign films that can be shown in the country. But under World Trade Organization rules, the quota system is supposed to end next year, meaning greater competition for local films.

“In addition to providing additional capital for its film and television production and financing activities, the transaction gives the studio an impressive circle of strategic and financial partners to facilitate further corporate growth,” Mr Ford said in a statement.

Source: Financial Times

Please

contact us in case of Copyright Infringement of the photo sourced from the internet, we will remove it within 24 hours.