The purchase of Swiss agribusiness Syngenta by ChemChina for US$44 billion – the largest ever foreign takeover by a Chinese firm – along with the unsuccessful US$14 billion approach from Chinese insurance firm Anbang to buy Starwood Hotels and Resorts, demonstrates the growing clout of Chinese firms when it comes to merger and acquisition (M&A) activity.

Foreign M&A deals by Chinese firms totaled $US95 billion in the first three months of the year, courtesy of the Syngenta acquisition, up an amazing 136% from the same levels a year earlier.

If that pace is sustained, it will surpass last year’s total of US$160 billion — the largest level on record — in a canter before the year is out.

To Gerard Burg, senior Asia economist at the NAB, the acceleration in Chinese M&A activity “demonstrates that there is more to the recent outflow of capital from China than hot money flows and debt repayment”.

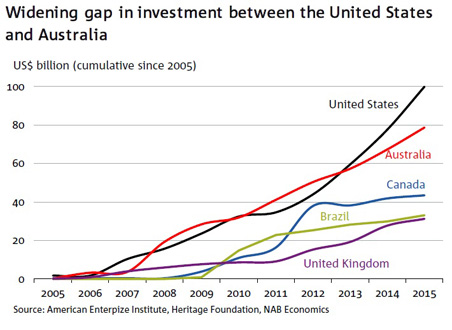

“China’s outbound foreign investment has accelerated across the past decade – rising from a relatively modest US$10 billion in 2005 to over US$110 billion last year,” says Burg.

“Over this period, China has gone from the nineteenth largest annual foreign investor to the third largest in 2014 – behind the United States and Hong Kong – for which the latter likely includes considerable investment by local subsidiaries on behalf of their mainland parent firms.”

The chart below, supplied by the NAB, reveals the top destinations for Chinese foreign investment over the past decade. It’s in cumulative terms, with investment in the United States topping the list ahead of countries with substantial mining and agricultural assets, Australia, Canada and Brazil.

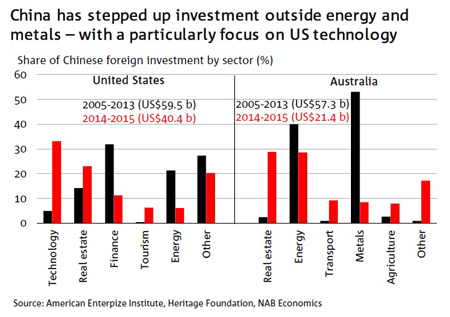

Along with the steep acceleration in foreign investment, particularly in the United States, Burg notes that the assets being acquired by Chinese firms are also changing in the composition.

“During the early phase of foreign investment, Chinese industrial firms were attempting to secure access to natural resources – many of which were in global undersupply due to previous periods of under-investment. This saw waves of investment into energy and metals sectors – particularly in countries such as Australia, Canada and Brazil – with the energy sector accounting for almost half of China’s total foreign investment between 2005 and 2013,” notes Burg.

“However, more recently the focus of investment has shifted. While energy remained the largest single sector for China’s global investment across 2014 and 2015, its share declined to around 22% of the total – with significant growth in Real Estate, Transport and Technology sectors.

“In the past two years, one-third of China’s investment in the United States has been directed towards the technology sector – with these investments likely to provide support to the country’s growing services sectors.”

The chart below, provided by Burg, shows the composition of Chinese investment into the United States and Australia, comparing investments made between 2005 to 2013 against those made in the two years to 2015.

For the United States, investment into technology companies has surged. In Australia, growth in investment in the real estate and energy sectors has also grown rapidly.

As a result of the Chinese government’s push towards services and consumption to bolster economic growth, Burg suggests that the foreign investment splurge will likely continue in the years ahead.

“The strength recorded in the first quarter suggests there is little reason to expect a slowdown in investment in 2016. Similarly the changing pattern of growth in China’s economy – away from heavy industry – is likely to continue to influence investment decisions – with further investment outside the energy and metals sector,” he says.

Business Insider Australia

Please

contact us in case of Copyright Infringement of the photo sourced from the internet, we will remove it within 24 hours.